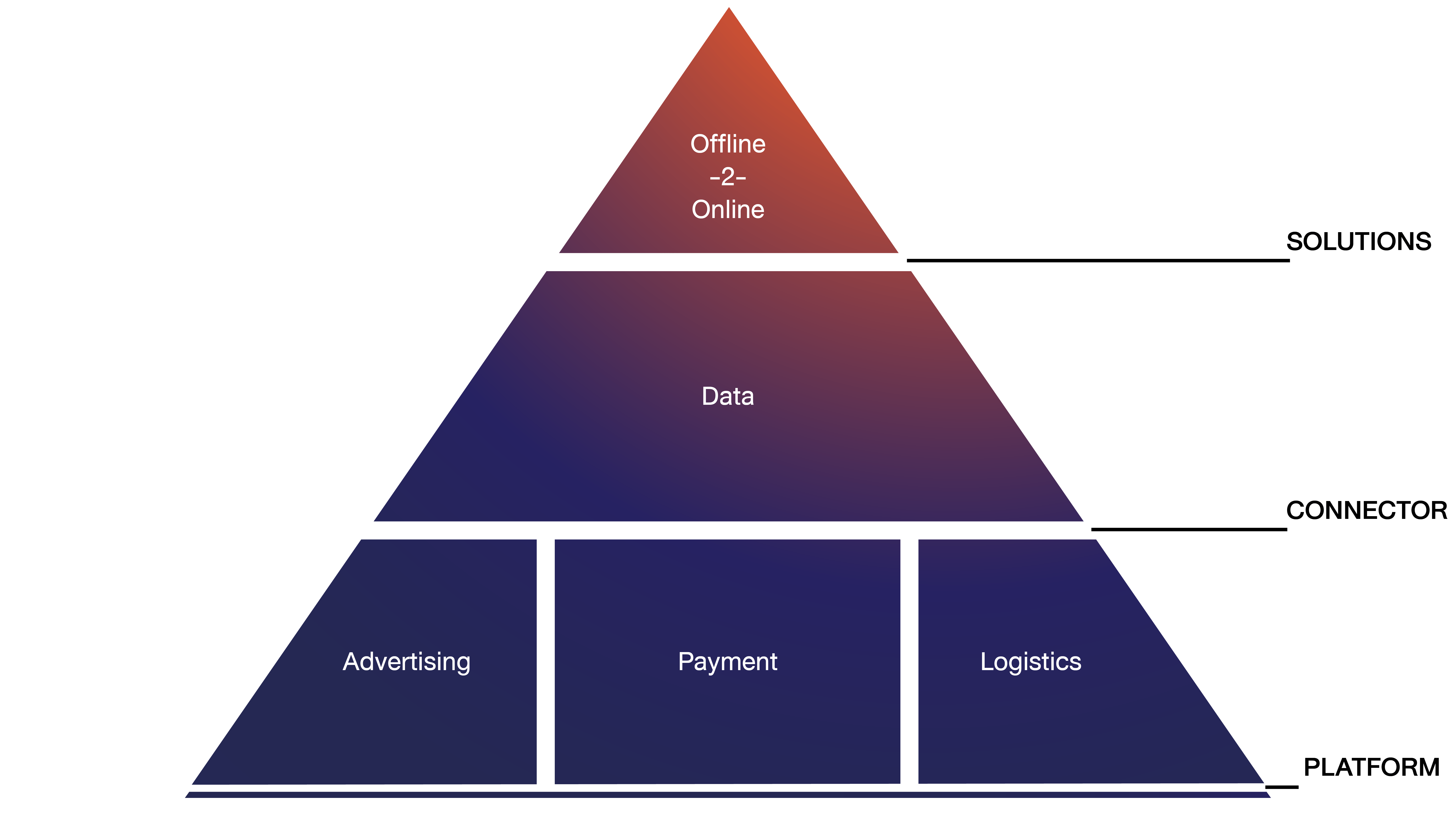

1. A unique position to grow revenue

VGI has branched out beyond the traditional offline Out-of-Home (“OOH”) to the online world, where we have successfully established ourselves as the market leader in Thailand. With the integration of OOH and our world-class online/digital platforms, bridged by the utilisation of the Rabbit Data, we envisioned ourselves as the leader in Offline-to-Online (“O2O”) Marketing Solutions, with the aim to create a seamless and meaningful customer experience both online and offline. Our sales strategy has therefore shifted from solely being a platform provider to one that offers O2O Marketing Solutions enabling advertisers to reach their target audiences at every stage of the consumer journey with greater efficiency and effectiveness.

2. Diversified world-class assets

Our diversified portfolio consolidates a multitude of OOH advertising channels from transit, outdoor and street to buildings and airports, with over THB 12,000m inventory on hand. Rabbit Group, our digital spearhead, has also partnered with key players in various industries including transportation, logistics, telecommunications, mobile and messaging and micropayment applications; thus, allowing us to reach over 18m reachable data, have allowed us to provide better predictions and smarter solutions for brands with relevant advertising, in the right place, at the right time and with the right message.

3. Leading and exclusive market positions

VGI is the leading provider of OOH media, which is the fastest growing media sector with over 50% market share in Thailand. Given the high barriers to entry in the mass transit industry, our competitive advantage lies in our unique contract portfolio, where we have secured 30-year exclusive contract with our parent company BTS to be the sole media provider in Bangkok CBD areas. At the same time, our future growth prospect is reinforced by our relationship with BTS given its preeminent role in mass transit development in Thailand, and with 5 to 6 times expected increase in transit media capacity by 2022/23. Meanwhile, our subsidiary business, the Rabbit Group, is also the largest micropayment service provider in Bangkok.

4. Strong financial position

Our financial position is exceptionally strong, underpinned by our prudent financial management and strategic approach to liquidity. We currently operate with no outstanding borrowings, free from the financial obligations and interest payments associated with debt. This is a significant advantage, as it allows us greater flexibility and resilience in managing our operations and pursuing growth opportunities. Our debt-to-equity (D/E) ratio is zero further underscores our financial stability. This minimizes our financial risk and enhances our ability to sustain operations through economic cycles.

Moreover, our high liquidity indicates that we have ample cash reserves and easily convertible assets on hand, ensuring that we can meet our operational needs without financial strain. It also positions us well to take advantage of investment opportunities or navigate unforeseen challenges with confidence.

Overall, our robust financial position not only reflects our commitment to maintaining a strong balance sheet, but also ensures our long-term stability and the capacity for strategic growth."

Strategy

Since VGI has successfully established itself as the Offline-to-Online (O2O) Solutions provider with a comprehensive ecosystem – Advertising, Payment and Logistics. We are able to offer higher quality of advertising and marketing campaigns at every touch point of the customer journey, bridging by the Group’s data to provide a better solutions for our clients.

Value

We believe in long-term value creation. Creating sustainable value for our shareholders, partners and society is our fundamental principle.

Growth

We aim to achieve industry-leading growth. Strengthening our unique business units and partnering with key complimentary market leaders around the world is our key growth differentiator.

Innovation

We commit to digital, technologies and R&D excellence to develop and launch new generation products and solutions that meet ever-changing consumer demands.

Outlook and Target:

In the FY2024/25, the Company will embark on a targeted strategy aimed at augmenting performance by prioritizing existing business ventures over the pursuit of expansion into new sectors. With a capital expenditures plan totaling THB 1bn, 50% of the funds will be earmarked for the advertising business, 20% for digital services enhancement and the remaining 30% for investments in the distribution business. As a result, revenue in FY2024/25 is expected to reach THB 6.0bn - THB 6.8bn.

With the support of various government measures aimed at boosting the economy and creating a more favorable business environment in the coming periods, the Bank of Thailand forecasts Thailand’s 2024 GDP growth at 3.8% with private consumption growth at 4.5% with the implementation of the Digital Wallet scheme. As the economy strengthens, the Company anticipates significant growth in its operation and overall performance driven by increased demand for its products and services. Hence, the Company is poised to capitalize on these opportunities, enhancing its market position and driving sustainable growth